Introduction to Recent Economic Developments

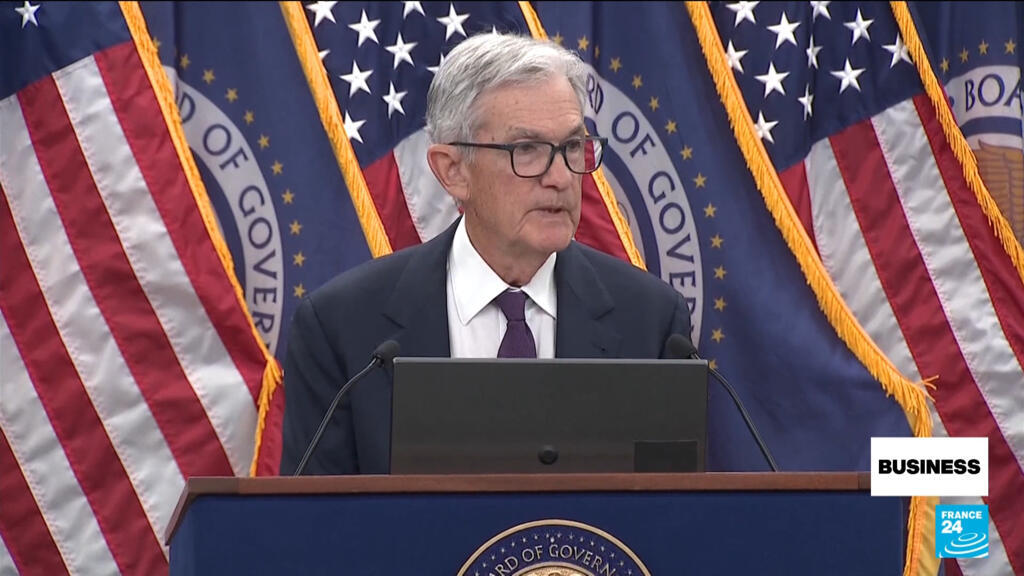

The Federal Reserve has made a significant decision regarding interest rates, choosing to keep them stable despite pressure from the President. This move comes at a time of heightened tension between the Federal Reserve and the government.

The Decision on Interest Rates

The Federal Reserve’s decision to maintain current interest rates is a notable stance against the wishes of the President, who had been advocating for a reduction. This choice reflects the central bank’s commitment to its independence and its mandate to manage the country’s monetary policy effectively.

Implications of the Decision

By keeping interest rates stable, the Federal Reserve aims to support the economy while also keeping inflation in check. This decision has implications for borrowers, savers, and the overall economic growth of the country. It signals the Fed’s cautious approach to monetary policy, weighing the need for economic stimulus against the risk of overheating the economy.

Tensions with the Government

The relationship between the Federal Reserve and the government has been under strain, with the Fed Chairman facing a criminal investigation. The Chairman has characterized this investigation as politically motivated, underscoring the challenges the central bank faces in maintaining its independence in the face of political pressure.

The Importance of Independence

The independence of the Federal Reserve is crucial for its ability to make decisions based on economic data and long-term considerations, rather than political expediency. The Chairman’s insistence on this independence highlights the importance of shielding monetary policy from political interference, ensuring that decisions are made with the sole aim of promoting economic stability and growth.

Economic Trends and the US Dollar

Meanwhile, the US dollar has been experiencing a decline, reaching its lowest level in four years. This slide reflects a combination of factors, including monetary policy decisions, economic performance, and global market trends. The weakening dollar has implications for trade, investment, and the overall competitiveness of the US economy.

Impact on Trade and Investment

A weaker dollar can make US exports more competitive abroad, potentially boosting trade. However, it can also lead to higher import prices, affecting domestic inflation. The impact on investment and the broader economy will depend on how these factors balance out and how other economic indicators evolve.

Other Notable Developments

In other news, Paris Fashion Week has been highlighting the rise of ultra-fast fashion, a trend that combines speed, affordability, and style. This shift in the fashion industry reflects changing consumer behaviors and the increasing demand for quick, affordable, and trendy clothing. The emphasis on ultra-fast fashion also raises questions about sustainability and the environmental impact of the fashion industry.

The Rise of Ultra-Fast Fashion

Ultra-fast fashion represents a significant change in how clothing is designed, produced, and consumed. It promises to deliver the latest fashion trends to consumers at unprecedented speeds and lower prices. However, this trend also faces criticism for its potential environmental and social costs, including waste, pollution, and labor rights concerns. As the fashion industry continues to evolve, finding a balance between speed, affordability, and sustainability will be a key challenge.